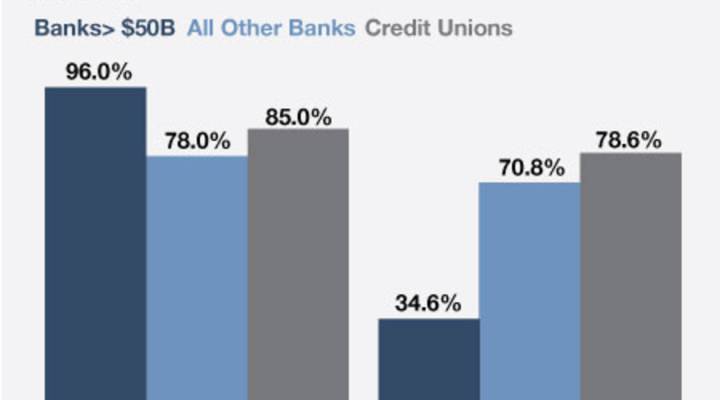

Want free checking? Don’t go to a big bank. A report from Moebs Services, which tracks banking activity, says the number of big banks offering free checking accounts has dropped to 34.5 percent, from 96 percent in 2009. The news that it’s costing Americans more to use banking services pushes the Marketplace Index down a point today.

Moebs notes that while free checking is on the decline, it’s still a lot more prevalent than it was a decade ago. in 2000, only about 40 percent of banks offered free checking, but that changed in the fight over customer deposits during the boom of 2000-2008. During that time, small banks were forced to adopt free checking in order to compete. Now they’re finding it tough to get rid of free checking…in order to compete.

Charging for checking accounts is “just not going to be possible for us. … We’d lose the accounts,” James Maloney, Chairman of Mitchell Bank in Milwaukee, told the American Banker. The Banker says free checking is still alive and well at most banks and credit unions with less than $50 billion worth of assets.

Of course, free checking isn’t free: someone has to pay for it, as Felix Salmon observed in a post last year.

…in recent years banks have been able to conjure the illusion of free through a system of regressive cross-subsidies, where the poor pay massive overdraft fees and thereby allow the rich to pay nothing.

Checking accounts pay zero interest these days, but even being able to borrow money for free from depositors isn’t worth $300 per year to a bank. If a checking account has $1,000 in it on average, and the bank can lend that money out at 7%, net of defaults, then it’s making $70 a year on the account, which isn’t enough to cover its costs.

The natural answer, here, is to restart charging monthly fees on modest-balance checking accounts — and to shed few tears when your low-balance customers leave.

The free checking picture is a little more nuanced than Moebs might have you believe, because of the banks’ varied offerings on the tier of checking accounts that they provide. I called up Chase this morning, and discovered that while your plain vanilla account costs $10 a month, you can avoid the charge by holding a minimum balance or using direct deposit. The higher you go up the tier, the higher the monthly fee, but again, you can avoid the fee altogether by holding the minimum balance.

So I guess checking is still free, even at the big banks, but only if you can afford to pay for it.

There’s a lot happening in the world. Through it all, Marketplace is here for you.

You rely on Marketplace to break down the world’s events and tell you how it affects you in a fact-based, approachable way. We rely on your financial support to keep making that possible.

Your donation today powers the independent journalism that you rely on. For just $5/month, you can help sustain Marketplace so we can keep reporting on the things that matter to you.