Explaining dividend recapitalization

There’s a lot of chatter these days about a private equity practice called “dividend recapitalization,” which sounds in some accounts like yet another bit of nefarious manipulation of the financial system by fat cat, tax-dodging investors. So let me explain what a dividend recap is and how it works, and you can decide whether it’s evil or not.

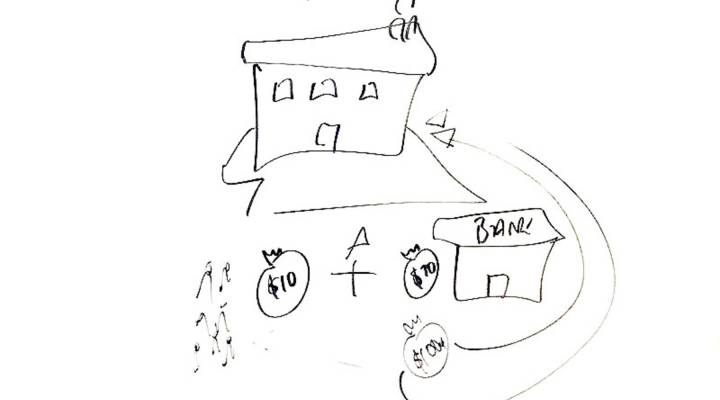

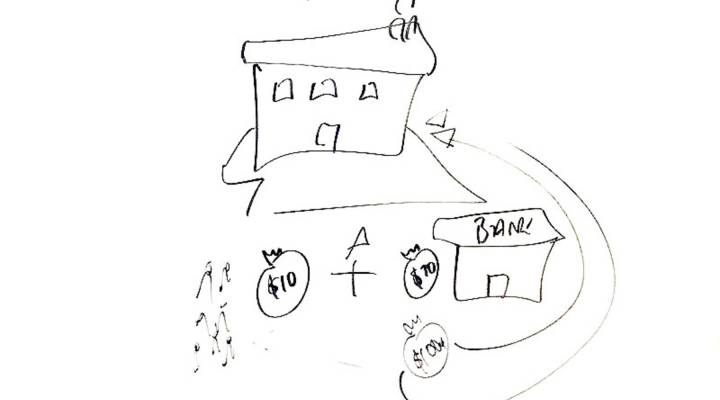

Imagine you decide to team up with a bunch of friends to buy a house. You all pitch in some money, and borrow the rest from the bank. Then you do the house up, flip it for a profit a few years later, pay back the bank and divide the cash amongst yourselves. That’s essentially how private equity works.

But what if you don’t want to wait several years for your big payout? If the value of the house has gone up, you could always take out a second mortgage on the home.

That’s essentially what a private equity company does in a dividend recapitalization. It goes back to the bank (or banks) and asks for a top-up loan. But rather than spending the money on something to benefit the company, the firm spends the money on itself, and pays a share to each of the partners. It pays itself a dividend, in other words.

This means, of course, that when the time comes to sell the company and pay back the bank, the bank will get more money and the PE firm will get less, but that’s OK, because the partners in the fund are reducing their risk by getting that early dividend payment.

So far so like a second mortgage. The difference between your “flip this house” team and a private equity firm is that when your team borrows from the bank, you are liable for the loan. If anything goes wrong with the investment, your team is on the hook. Private equity firms, however, do not hold the debt when they buy companies. Instead they pile all that debt onto the company that they’ve bought. So if things go wrong, and the company fails, the partners in the private equity firm only lose the capital they put up.

That’s right, don’t have to pay back any of the loan, neither the original loan, nor the top-up: that’s up to the company. So in the event of a failed investment, if the private equity firm has done a dividend recap and pulled some money out of the deal early, the partners are very happy.

The company, which has been burdened by more debt… not so much.

There’s a lot happening in the world. Through it all, Marketplace is here for you.

You rely on Marketplace to break down the world’s events and tell you how it affects you in a fact-based, approachable way. We rely on your financial support to keep making that possible.

Your donation today powers the independent journalism that you rely on. For just $5/month, you can help sustain Marketplace so we can keep reporting on the things that matter to you.