Former Fed official who oversaw reforms sees “deep irony” after bank collapse

Former Fed official who oversaw reforms sees “deep irony” after bank collapse

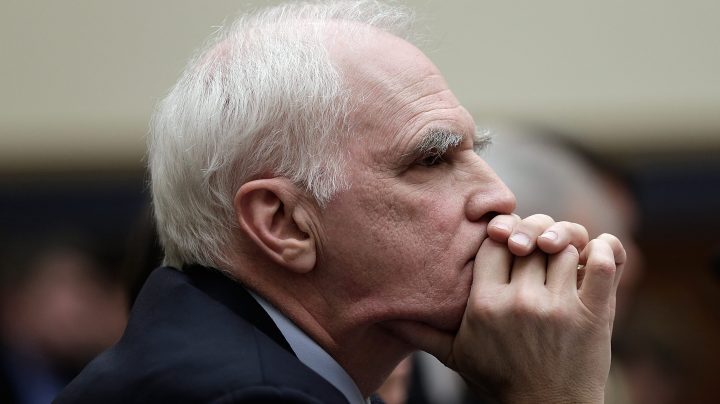

Nowadays, Daniel Tarullo teaches at Harvard Law School. But not too long ago, he was leading the charge on bank regulation.

Between 2009 and 2017, Tarullo was on the Federal Reserve Board of Governors; specifically, he served as oversight governor for the supervision and regulation committee. During that time, he led the board’s financial regulatory reforms, including the implementation of the Dodd-Frank Act.

He joined “Marketplace’s” Kai Ryssdal to talk about how Silicon Valley Bank’s collapse happened and how it might change the banking industry. The following is an edited transcript of their conversation.

Kai Ryssdal: With the stipulation that this is not 2008 or 2009, what do you suppose it was like in the Fed Friday afternoon and Saturday?

Daniel Tarullo: Well, I suspect that they were scrambling. The problems with Silicon Valley Bank came with very little or no warning. You know, usually, Kai, when you’ve got financial stress of some sort, you have at least some indications that it’s going to happen. The adrenaline level still goes up once it starts, but at least you’ve had a chance to think it through. And here I suspect that even their diagnosis of what was going on was not very firm. And as I understand, it changed over the course of the weekend.

Ryssdal: All right, so look, that’s why we got you on the phone. You ran, among other things you did at the Fed, the committee on supervision and regulation. And I am not the first person to ask, nor will I be the first person to ask, where were the regulators? Why did this come out of the blue?

Tarullo: That’s a huge question, isn’t it? There are two places to look: One is to supervision and the other is to regulation. Now, of course, we’re stipulating that there’s a management failure, but I think everybody would agree with that. So in terms of the government, the debate publicly has been, “Gee, were the 2018-2019 changes in the [Dodd-Frank] law and Fed regulations respectively to blame?” And, as I think you know, I was opposed to both the [rollback of the] law and the changes in the regulations. But I don’t think there’s that direct of a connection between those specific changes and Silicon Valley. And so what that tells us is the failure was in the oversight by supervisors — people who were supposed to be watching whether things like the proportion of uninsured deposits was creating some unusual risks for that particular bank.

Ryssdal: That’s not terribly reassuring, I gotta tell you,

Tarullo: No, it’s not. And I think that the review that the Fed has launched — and it’s significant that it’s headed by the vice chair for supervision, Michael Barr, who is, you know, relatively new — I think the significance of having him run that rather than staff is precisely because they want to find out where the supervisory failures lay. Were they with the specific team that had responsibility for Silicon Valley? Or were the failures more widespread in the sense that Washington was providing kind of a light touch supervisory direction to them?

Ryssdal: What do you think?

Tarullo: I suspect that it’s a combination of the two. But given the signals that the Fed was sending, you know, in the last several years, I believe that part of it is just the “don’t be too tight in your supervision, you need to find legal problems before you tell the banks to change what they were doing.”

Ryssdal: With the barn door firmly open and the horse gone, let me ask you about what happens next. First of all, on this idea that the Fed and the Federal Deposit Insurance Corp. and the Treasury over the weekend invoked the systemic risk exception to cover uninsured depositors, can we read that as functionally now all deposits and American banks are basically insured?

Tarullo: Well, there’s a deep irony here, isn’t there, Kai? Because if you are a large depositor, you are now saying to yourself, “You know what, if I put my large deposit into a bank that already has a bunch of large uninsured deposits, then I’m more likely to get bailed out because they’re worried about the run.” So clearly, the regulatory approach is going to have to change here, because that’s the worst kind of incentive. I agree with the premise of your question, that we’ve just seen an uptick in moral hazard. And look, when the 16th largest bank in the country — we’re not talking Citi, we’re not talking JPMorgan, we’re not talking Wells Fargo — the 16th largest bank cannot be allowed to fail under the normal rules that apply to bank failures, that really does tell you that one of those pillars of Dodd-Frank — which is to let banks fail and people will have the right incentives — we just can’t rely on that.

Ryssdal: So now what happens in the weeks and months to come? There’s going to be the Fed review, Congress will surely be involved, more regulations coming. What do you think?

Tarullo: I do think there’ll be more regulation. I would expect that there may be some rollback on the deregulatory changes, particularly the Fed’s 2019 regulation. But the scope of those, Kai, I think is going to depend on what they learn about how many banks were vulnerable. The other thing which people do need to discuss, even though it has some politically unappealing attributes to it, is should we be insuring more than $250,000? And the reason for that, of course, is that you prevent runs and you prevent money from moving into money market funds. But if you do that, you really do need more stringent regulation of the banks that hold those large — but now-insured — deposits.

Ryssdal: And that will be quite the fight, right? I mean, you spent enough time in Washington to know that there’s going to be a knockdown, drag-out over that.

Tarullo: Absolutely. This is not going to be a political no-brainer.

There’s a lot happening in the world. Through it all, Marketplace is here for you.

You rely on Marketplace to break down the world’s events and tell you how it affects you in a fact-based, approachable way. We rely on your financial support to keep making that possible.

Your donation today powers the independent journalism that you rely on. For just $5/month, you can help sustain Marketplace so we can keep reporting on the things that matter to you.