What the debt ceiling deal means for your student loans

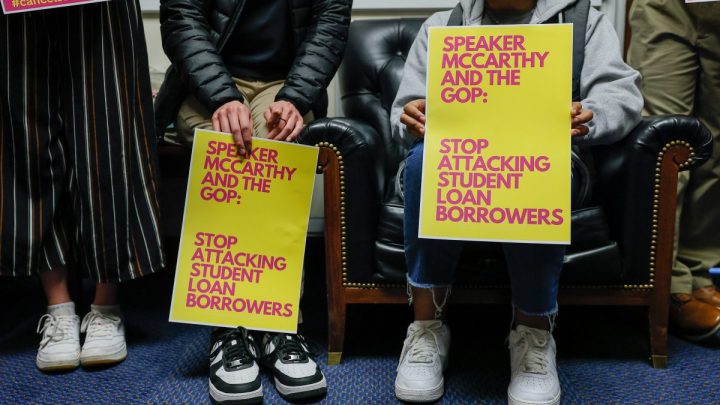

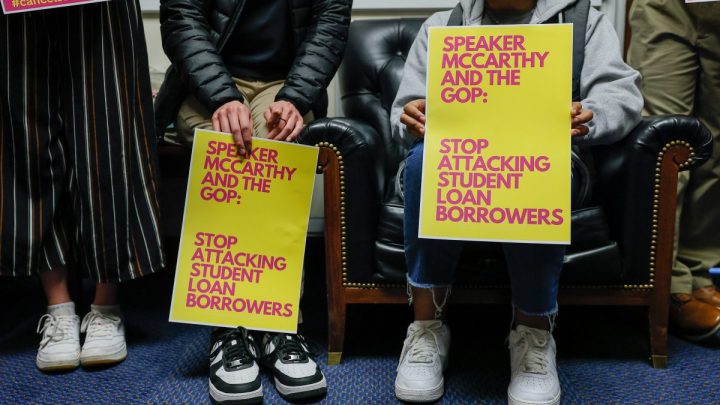

Friday, the Senate approved the debt limit deal to avoid a U.S. default. The deal negotiated by House Speaker Kevin McCarthy and President Joe Biden would raise the debt ceiling until 2025 while cutting some government spending. It now goes to Biden for signing.

The debt limit deal includes new work requirements for recipients of some government benefits, nearly $21.4 billion of IRS budget cuts, and a provision that prevents Biden from extending the pause on federal student loan repayments without approval by Congress. However, the proposed legislation would not prevent Biden from pausing student loan payments during another qualifying emergency.

When will loan repayments resume?

According to the bill, borrowers will be required to start paying on loans 60 days after June 30, putting it around August 29 at the latest. The Department of Education extended the pause on payments in November to give the Supreme Court time to review the challenge to Biden’s loan forgiveness plan. The Federal Student Aid website says borrowers should receive a billing statement at least 21 days before their first payment is due, but to check with loan providers in the meantime for a payment estimate and due date.

Will I have to pay interest again?

Yes, when payments restart, interest will begin to accrue again. The interest rate for most borrowers will be the same as it was before the pause, according to the Federal Student Aid website.

Can I pause my repayments on my own?

Yes, you can temporarily stop payments if you qualify for deferment or forbearance. Interest will continue to accrue in most cases, the website says. There is also an extended repayment plan with fixed or graduated monthly payments for up to 25 years that are usually lower compared to other repayment plans.

What about student loan forgiveness?

Biden’s student loan forgiveness plan is not part of the debt ceiling deal; whether it moves forward or not is a decision that rests with the Supreme Court. An estimated 43 million people would be eligible for up to $20,000 in debt relief under Biden’s plan at a cost of about $400 billion. If the plan moves forward, some borrowers would be eligible for up to $10,000 in debt relief; Pell Grant recipients would be eligible for an additional $10,000.

What happens if the court rules against Biden’s debt forgiveness plan?

If the Supreme Court rules against the plan, there are plans to reform income-driven repayment programs to help middle and lower-income borrowers. IDRs, as they are known, can trap a person in debt with negative amortization on loans, where payments aren’t enough to cover interest and the amount you owe goes up. Also, the Education Department can offer debt relief on a “case-by-case” basis if the Supreme Court rules against the student loan forgiveness plan, Slate reported.

There’s a lot happening in the world. Through it all, Marketplace is here for you.

You rely on Marketplace to break down the world’s events and tell you how it affects you in a fact-based, approachable way. We rely on your financial support to keep making that possible.

Your donation today powers the independent journalism that you rely on. For just $5/month, you can help sustain Marketplace so we can keep reporting on the things that matter to you.