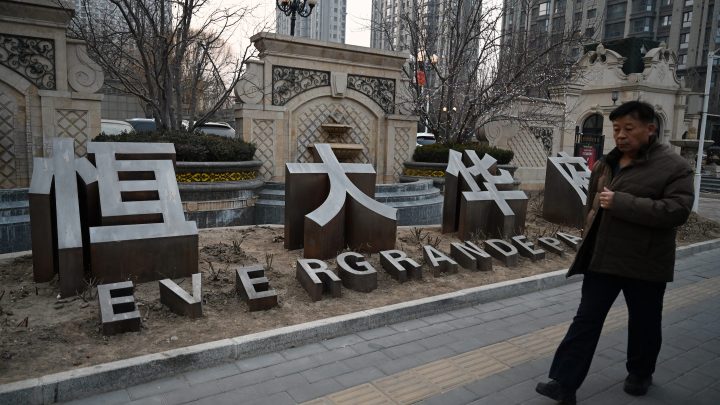

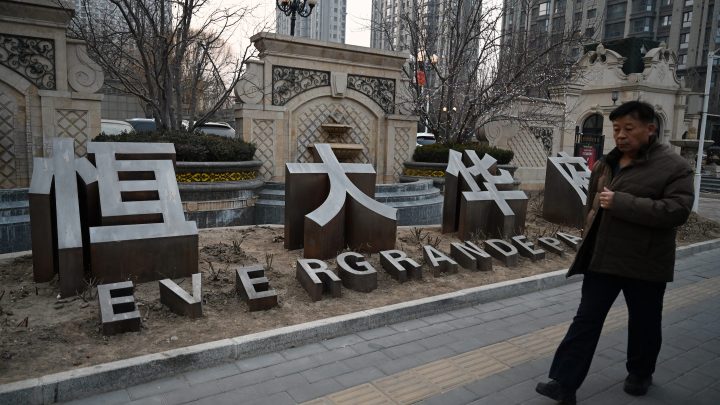

With Chinese developer Evergrande set to liquidate, impact may spread beyond investors

With Chinese developer Evergrande set to liquidate, impact may spread beyond investors

On Monday, a bankruptcy court in Hong Kong ordered the liquidation of what is not only China’s, but the world’s, most-indebted property developer, called Evergrande.

The company, with $300 billion in liabilities, has been trying to restructure for more than two years — unsuccessfully. This appears to be the end of the line.

Unwinding the company and selling off its assets, which include many unfinished developments in China, will be a complicated process with complicated economic effects.

This massive bankruptcy could be a new drag on China’s economy and financial markets, which are already in the doldrums, said Eswar Prasad, a professor of trade policy at Cornell University.

“This is one of the biggest dominoes in the Chinese property market, and it’s taken a long time to fully fall to the ground,” he said.

Real estate is one of the main ways Chinese families invest their wealth. So one of the most surprising things about this bankruptcy, Prasad said, is that the government isn’t intervening to keep Evergrande afloat.

“The government is not going to ride to the rescue. There are people who are going to lose money,” he said.

Investors are likely in for a rough ride, said Nicholas Lardy, a senior fellow at the Peterson Institute for International Economics and an expert on the Chinese economy.

“I don’t think they’re going to recover very much. It’s going to be pennies on the dollar,” he said.

Still, Lardy said the Chinese government will try to keep some money flowing to get stalled housing projects completed.

“So this was a political problem for the government,” he said. “People took out mortgages to buy these properties. And so they were paying on their mortgages, and for a while it looked like they’d never get the units they bought.”

Meanwhile, foreign creditors may find themselves behind Chinese ones in the repayment line, said Prasad of Cornell.

“Given how nervous both domestic and foreign investors are at the moment, there might be a surge of capital leaving the country. There might be some depreciation pressures on the currency,” he said.

Not great for China, obviously. But not necessarily bad for China’s rivals, said Chris Jackson, senior vice president at polling firm Ipsos.

“You look at places like Malaysia. A lot of times they’re benefiting when China is going through some challenges because they’re seen as a safer alternative for Western companies who are looking to source products or services,” he said.

And some of China’s neighbors are on a roll. India, Indonesia, Thailand and Singapore have the most upbeat consumers in the world right now.

There’s a lot happening in the world. Through it all, Marketplace is here for you.

You rely on Marketplace to break down the world’s events and tell you how it affects you in a fact-based, approachable way. We rely on your financial support to keep making that possible.

Your donation today powers the independent journalism that you rely on. For just $5/month, you can help sustain Marketplace so we can keep reporting on the things that matter to you.