A year after the banking crisis, many small businesses are less worried about their deposits

A year after the banking crisis, many small businesses are less worried about their deposits

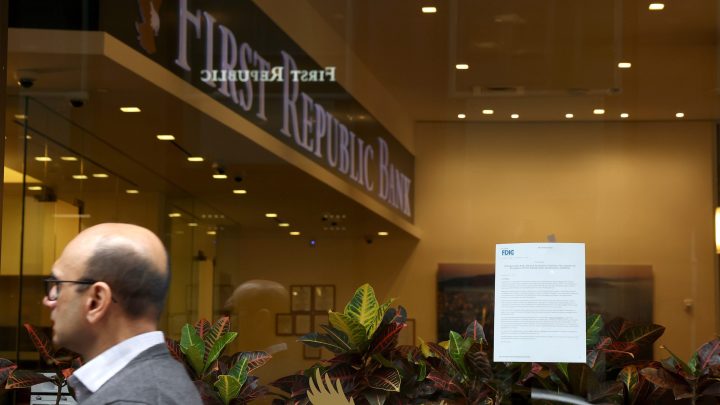

A year ago, a crisis was brewing beneath the surface of the banking sector. It erupted a little over a month later, when mid-sized financial institutions started collapsing. By May, Signature Bank, Silicon Valley Bank and First Republic Bank had all failed.

The crisis didn’t last long, thanks in large part to government intervention. But in the immediate wake of the crisis, there was a lot of concern that other banks might fail if depositors decided to pull out their money.

Last March, many business owners were worried about the safety of their bank deposits. Back then, Nate Tobik, the founder of Complete Bank Data, a business that sells market data to banks, said he was worried about what might happen if his own bank failed.

“To be candid, our business has an account at a community bank, and we’re going to be opening another account at Chase because it’s too big to fail,” Tobik said last year.

The problem, Tobik said, was that he was keeping more than $250,000 his bank — more than the limit protected by the Federal Deposit Insurance Corp. Tobik decided to spread out his money among accounts at different banks, all with balances below the FDIC limit.

“We went from one to three accounts, and figured that was enough to keep the risk to an acceptable level,” Tobik said in a recent interview.

But since then, Tobik said he’s allowed his balances to rise above the FDIC-insured limit again. And even though he could technically lose money if one of his banks fails, Tobik said he sleeps just fine at night, because the fears that people would run on their banks and cause more of them to fail never materialized.

“Even though deposits left, in many of these cases, it wasn’t a widespread thing,” Tobik said. “Most deposits stayed still once the dust settled.”

Also, Tobik said he realized that managing all of those bank accounts for his business is a ton of work.

“The biggest thing is actually managing balances on those accounts and transferring money back and forth to try and make sure they’d all be below the limit,” Tobik said. “Also, figuring out how to run payroll through those things.”

A lot of banks have come up with ways to deal with those headaches and still keep FDIC protection.

Spiro Pappadopoulos, the CEO of Schlow Restaurant Group, which operates seven businesses in several states, signed up for a program his bank offers that automatically moves money to and from other banks if the balance exceeds the FDIC limit.

“If we were building a new restaurant or something and had to write a check for an amount greater than that, we wouldn’t even have to do anything,” Pappadopoulos said. “The bank would just automatically pull money from another account.”

Pappadopoulos said businesses like his need to hold on to a lot of cash. A restaurant’s payroll, for instance, could be $70,000 a week.

And even though the risk of an actual bank failure is a lot lower now, Pappadopoulos said he’s still going to keep his money protected. That’s because last year’s banking crisis was a big reminder to stay vigilant.

“It’s so easy for us to hone in for our business, on restaurants,” Pappadopoulos said. “But we could be negligent if we’re not aware of the bigger machinations in the economy.”

That said, a lot of other businesses weren’t really all that shaken by the banking crisis.

“I haven’t even probably heard about it since the month it happened,” said Lorilyn Wilson, an accountant and owner of Lake Oswego Tax in Oregon.

Wilson said none of her clients pulled any money out of their banks. One reason is that businesses that have a lot of cash on hand want to use it to make more.

“If you’re sitting on money, let’s make the money work for you,” Wilson said. “Is there a mutual fund? Are there some bonds you can invest in?”

Wilson said most of the clients she works with, including retailers, health care providers and marketing companies, tend to spend the cash they earn pretty quickly.

“Most of their concerns right now are not with, like, ‘Will the banking system fail?’” Wilson said. “It’s, ‘Will I have enough money to cover my bills with the rising cost of everything?’”

In other words, those businesses are a lot less likely to keep more than the FDIC’s $250,000 limit in the bank.

There’s a lot happening in the world. Through it all, Marketplace is here for you.

You rely on Marketplace to break down the world’s events and tell you how it affects you in a fact-based, approachable way. We rely on your financial support to keep making that possible.

Your donation today powers the independent journalism that you rely on. For just $5/month, you can help sustain Marketplace so we can keep reporting on the things that matter to you.