My boyfriend wants to pay my rent

Sometimes you run into a problem so tough, so awkward, so infuriating, you have to assemble all your best and brightest friends to vent, commiserate and figure it out.

That’s the idea behind our occasional advice segment “The Group Chat.” We bring in friends of the pod to address your biggest money and job problems. This week we’re joined by Sam Sanders, host of NPR’s “It’s Been a Minute,” and Sarah Menendez, Marketplace’s product specialist and Reema’s personal real-life advice giver.

Listen to every “Group Chat” episode here and find a few edited highlights from this week’s installment below.

I am uncomfortable when it comes to deciding the line between indulgence vs. quality purchase. Is buying the fancy olive oil too much of an indulgence? Should I be guilty about spending $25 on a new pair of fancy underwear instead of buying a pack of three for the same price? Should I feel guilty about buying good seats (instead of the cheap seats) for one of my favorite bands? My parents rarely took us out to eat without some sort of coupon. We usually got the cheapest seats when going to sports games. My parents were also avid coupon clippers. I believe in being frugal, but I also want to enjoy things and get good-quality stuff without a feeling of guilt. Help!

Sarah Menendez: Oh, my God, I wish I felt more like this. I truly be going into Target and buying everything in the name of self-love and self-care. I think that a lot of this is like a holdover of his parents, what they’ve imparted on him. And I know you, and I have talked about this, Reema, feeling like you have to justify purchases to your parents even though you don’t live with them anymore. You know? It’s not their money, it’s your money. But you still feel like a little bit of like, “How am I going to justify the spending to my parents?”

Sam Sanders: When I heard this question, it made me think, “This is more than just buy-the-nice-thing or not-the-nice-thing.” It seems as if there’s a larger issue of money management throughout his month. So my advice to you would be: Every pay cycle, every month, however you do it, sit down and say this much money goes to savings, this much money goes to retirement, this much money goes to rent, whatever. The rest of it, I can do whatever I want. Have that fun, little playscape money. And then you can spend all that money if you want just on olive oil! Because you’ve taken care of the other stuff.

Menendez: Gallons of it!

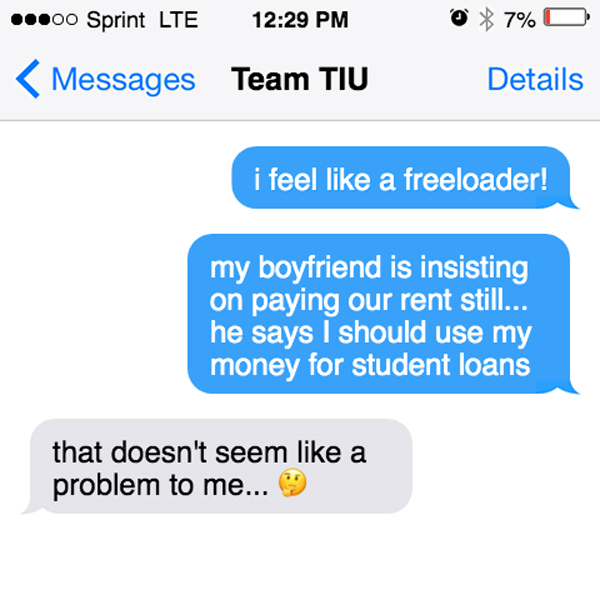

So my boyfriend and I have been living together for about four years. And since then he’s pretty much paid for everything, like most of our dates and even our rent. He has a really large trust fund and insists that I put money that I make from my part-time job toward my student loans. Now I’m about to start a Ph.D. program, and he’s still insisting that I not put money toward the rent. This has obviously been great for my financial situation, but I’m feeling kind of like a freeloader, which makes me feel uncomfortable. I love him and we talked about getting married, but I have misgivings about the situation. What do you all think? Should I be happy with the situation and get rid of my student debt? Or keep pushing to pay some of the rent?

Sanders: I don’t see a problem. Send your problem to me! He can come live downtown with Sam, pay my rent, I’ll get a Ph.D.! [Laughs] I don’t see a problem.

Menendez: Also, one of the things that clicked as soon as I heard this is: He’s asking you to put money down in your student loans, and then you guys are talking about marriage … that’s because he doesn’t want to carry your debt.

Reema Khrais: Yeah, like at the end of the day this is for his happiness. He’s investing in his happiness [and] their relationship. I think the only way that this could be problematic is if he uses the money to hold it over [them] or to manipulate something … you know, if it becomes an imbalance and messes up the power dynamic at all, but doesn’t sound like that. It sounds like a healthy relationship.

Sanders: Also, what you can do is find other ways to, in your mind, repay him. Save your own money to buy him a nice gift from time to time, or vacation. Save on your own so if down the road you want to buy a house together. You can actually chip in to this down payment, and you’ll feel very good about that. So the money he’s allowing you to save now, save it with him in mind. There might be an opportunity down the road to give it back to him in some way.

Got anything you want to run by the group chat? Fill out the form below, and don’t forget to subscribe to our newsletter.

The future of this podcast starts with you.

We know that as a fan of “This Is Uncomfortable,” you’re no stranger to money and how life messes with it — and 2023 isn’t any different.

As part of a nonprofit news organization, we count on listeners like you to make sure that these and other important conversations are heard.